To serve you better, our new website displays information specific to your location.

Please visit the site and bookmark it for future use.

You are here

SRK Kazakhstan ›Cave mining risks - not necessarily greater, but definitely different

|

Download A4 | Letter |

Neil Winkelmann, Senior Consultant

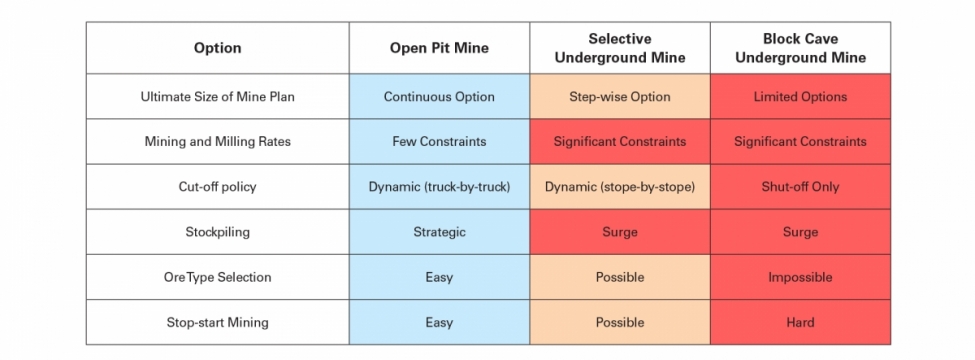

Cave mining, and in particular block-cave mining, stands at one end of the spectrum of mining method-related risks. It is not so much that the risks are greater, but rather that the ability of management to respond to variations in expected conditions is much less than with other mining methods. Compounding this in the case of extraction-level stability risk is that small issues can quickly become large issues as the cave operations are slowed and the geotechnical stresses build.

A conventional open-pit mine makes few irreversible decisions in the planning phase. The size of the mining fleet, the mining rate, the cut-off policy, and the stockpiling strategy can (and should) all be dynamically adjusted in response to economic and technical parameters to maximise cashflows and profits. The pit-slope angles, dewatering strategy and support strategy can all be adjusted as experience is gained and the geotechnical context and behavior is better understood throughout the mine life. The size and type of the processing facility (and its location) are really the only ‘fixed’ decisions at the time construction commences.

Contrast this to a block cave. Many major and effectively permanent decisions must be made before any operating experience at all is obtained. The orebody must effectively be delineated on five of the six sides before production starts. Only the shut-off policy remains available to optimise economics. The geotechnical context must be perfectly characterised, and designs developed to ensure stability of the extraction-level under the as-yet untested loading environment. No significant redesign on the fly is possible. Production rates are effectively set by infrastructure and layout. Cut-off grades have been 80% defined by the footprint configuration and a dynamic policy. Responding to economic drivers isn’t possible.

Although sublevel caves (and other level-based variants) have a bit more flexibility, the implication of this is that there is great value in investing in a comprehensive strategic evaluation process for cave mines generally, quantitatively considering risk through sensitivity and scenario analysis, and assessing the degree to which design decisions stand up to inevitable variation. Getting it right up-front is essential. This is where the value is really created in cave mines. In contrast, the value in an open pit mine is created primarily through dynamic optimisation over the mine operations period, rather than at the initial design phase.

Neil Winkelmann: nwinkelmann@srk.com

Pictured above: Cave Mining – Optionality in Operation